The Industrial AI Reformation

The Industrial AI Reformation

The Industrial AI Reformation

SUMMARY

SUMMARY

EU companies have notably increased R&D investments, outpacing US and Chinese markets for the first time in a decade. Despite macro headwinds, now it's time to build on this momentum by leveraging AI to enhance industrial innovation, efficiency and resilience.

EU companies have notably increased R&D investments, outpacing US and Chinese markets for the first time in a decade. Despite macro headwinds, now it's time to build on this momentum by leveraging AI to enhance industrial innovation, efficiency and resilience.

EU companies have notably increased R&D investments, outpacing US and Chinese markets for the first time in a decade. Despite macro headwinds, now it's time to build on this momentum by leveraging AI to enhance industrial innovation, efficiency and resilience.

WRITTEN BY

WRITTEN BY

Adrian Klee

Adrian Klee

Adrian Klee

PUBLISHED

PUBLISHED

12.03.2025

12.03.2025

12.03.2025

Introduction

The European industrial base is the driving force behind globally leading products, from advanced aerospace technologies and cutting-edge industrial automation solutions to high-performance precision machinery.

Manufacturing plays a significant role, accounting for roughly 16.4% of the gross value added in the EU and generating a nominal value of 5.9 trillion Euros of sold production in 2023 (Eurostat). However, industrial firms currently grapple with macro headwinds of historic scale: geopolitical instability, stagnant growth, margin compression. On top, rapid technological progress, especially in artificial intelligence (AI), continues to create an asymmetrical shift in global competition. At Kausal Labs, we built and advised some of the most advanced industrial tech companies over the last two decades, hence we believe that despite the challenging economic environment this is the beginning of a new era that bears immense opportunity - and artificial intelligence is right at the center of it.

In this post, we outline:

the macro challenges that industrials currently face

why AI is becoming a critical enabler of future growth

a new organisational framework on how to efficiently implement AI

Let’s dive into it.

Introduction

The European industrial base is the driving force behind globally leading products, from advanced aerospace technologies and cutting-edge industrial automation solutions to high-performance precision machinery.

Manufacturing plays a significant role, accounting for roughly 16.4% of the gross value added in the EU and generating a nominal value of 5.9 trillion Euros of sold production in 2023 (Eurostat). However, industrial firms currently grapple with macro headwinds of historic scale: geopolitical instability, stagnant growth, margin compression. On top, rapid technological progress, especially in artificial intelligence (AI), continues to create an asymmetrical shift in global competition. At Kausal Labs, we built and advised some of the most advanced industrial tech companies over the last two decades, hence we believe that despite the challenging economic environment this is the beginning of a new era that bears immense opportunity - and artificial intelligence is right at the center of it.

In this post, we outline:

the macro challenges that industrials currently face

why AI is becoming a critical enabler of future growth

a new organisational framework on how to efficiently implement AI

Let’s dive into it.

Introduction

The European industrial base is the driving force behind globally leading products, from advanced aerospace technologies and cutting-edge industrial automation solutions to high-performance precision machinery.

Manufacturing plays a significant role, accounting for roughly 16.4% of the gross value added in the EU and generating a nominal value of 5.9 trillion Euros of sold production in 2023 (Eurostat). However, industrial firms currently grapple with macro headwinds of historic scale: geopolitical instability, stagnant growth, margin compression. On top, rapid technological progress, especially in artificial intelligence (AI), continues to create an asymmetrical shift in global competition. At Kausal Labs, we built and advised some of the most advanced industrial tech companies over the last two decades, hence we believe that despite the challenging economic environment this is the beginning of a new era that bears immense opportunity - and artificial intelligence is right at the center of it.

In this post, we outline:

the macro challenges that industrials currently face

why AI is becoming a critical enabler of future growth

a new organisational framework on how to efficiently implement AI

Let’s dive into it.

01 - MACRO OUTLOOK

The EU industrial sector faces macro headwinds of historic scale

The EU industrial sector faces macro headwinds of historic scale

The EU industrial sector faces macro headwinds of historic scale

Over the past decade, European industry experienced steady, but moderate growth. Up until a couple of rapid macro events triggered a tectonic shift in the operating environment: First, the UK’s 2020 EU exit added trade frictions that disrupted previously integrated supply chains, resulting in a decline of around ~15% in EU-UK goods trade volumes (University of Birmingham). Second, the Covid-19 pandemic triggered factory shutdowns and demand shocks, leading to the steepest industrial recession in decades. Subsequent supply chain disruptions, ranging from global shipping bottlenecks to semiconductor shortages, additionally slowed down production. For instance, a prolonged chip shortage in 2021–2022 forced European automakers to cut output, costing an estimated €100 billion in lost value added, around 0.8% of EU GDP, over those two year (Allianz). Third, recent geopolitical tensions have created additional headwinds: Strained EU–China relations have triggered calls for de-risking supply chains, as Europe remains heavily dependent on China for critical inputs such as rare earth elements: 39% of EU rare earth elements imports came from China (EU Commission). Meanwhile, Russia’s 2022 invasion of Ukraine initiated an energy crisis that severely impacted European industry due to the region’s historical reliance on Russian gas. Industries like metals, chemicals, glass, and fertilizer, which rely on gas or electricity as fuel had to curtail production in late 2022 due to cost or physical shortages. Up until today, industrial energy costs remain well above pre-2021 norms.

Pressure from global markets additionally weighs on European industry’s competitiveness.

Europe's position in global manufacturing has been challenged by the rise of China and the resurgence of the United States: China is now the world’s manufacturing behemoth, accounting for 28.8% of global manufacturing value added. In contrast, the share of the EU currently accounts for 16.9% and the USA for 15.4% (World Bank).

Over the past decade, European industry experienced steady, but moderate growth. Up until a couple of rapid macro events triggered a tectonic shift in the operating environment: First, the UK’s 2020 EU exit added trade frictions that disrupted previously integrated supply chains, resulting in a decline of around ~15% in EU-UK goods trade volumes (University of Birmingham). Second, the Covid-19 pandemic triggered factory shutdowns and demand shocks, leading to the steepest industrial recession in decades. Subsequent supply chain disruptions, ranging from global shipping bottlenecks to semiconductor shortages, additionally slowed down production. For instance, a prolonged chip shortage in 2021–2022 forced European automakers to cut output, costing an estimated €100 billion in lost value added, around 0.8% of EU GDP, over those two year (Allianz). Third, recent geopolitical tensions have created additional headwinds: Strained EU–China relations have triggered calls for de-risking supply chains, as Europe remains heavily dependent on China for critical inputs such as rare earth elements: 39% of EU rare earth elements imports came from China (EU Commission). Meanwhile, Russia’s 2022 invasion of Ukraine initiated an energy crisis that severely impacted European industry due to the region’s historical reliance on Russian gas. Industries like metals, chemicals, glass, and fertilizer, which rely on gas or electricity as fuel had to curtail production in late 2022 due to cost or physical shortages. Up until today, industrial energy costs remain well above pre-2021 norms.

Pressure from global markets additionally weighs on European industry’s competitiveness.

Europe's position in global manufacturing has been challenged by the rise of China and the resurgence of the United States: China is now the world’s manufacturing behemoth, accounting for 28.8% of global manufacturing value added. In contrast, the share of the EU currently accounts for 16.9% and the USA for 15.4% (World Bank).

Over the past decade, European industry experienced steady, but moderate growth. Up until a couple of rapid macro events triggered a tectonic shift in the operating environment: First, the UK’s 2020 EU exit added trade frictions that disrupted previously integrated supply chains, resulting in a decline of around ~15% in EU-UK goods trade volumes (University of Birmingham). Second, the Covid-19 pandemic triggered factory shutdowns and demand shocks, leading to the steepest industrial recession in decades. Subsequent supply chain disruptions, ranging from global shipping bottlenecks to semiconductor shortages, additionally slowed down production. For instance, a prolonged chip shortage in 2021–2022 forced European automakers to cut output, costing an estimated €100 billion in lost value added, around 0.8% of EU GDP, over those two year (Allianz). Third, recent geopolitical tensions have created additional headwinds: Strained EU–China relations have triggered calls for de-risking supply chains, as Europe remains heavily dependent on China for critical inputs such as rare earth elements: 39% of EU rare earth elements imports came from China (EU Commission). Meanwhile, Russia’s 2022 invasion of Ukraine initiated an energy crisis that severely impacted European industry due to the region’s historical reliance on Russian gas. Industries like metals, chemicals, glass, and fertilizer, which rely on gas or electricity as fuel had to curtail production in late 2022 due to cost or physical shortages. Up until today, industrial energy costs remain well above pre-2021 norms.

Pressure from global markets additionally weighs on European industry’s competitiveness.

Europe's position in global manufacturing has been challenged by the rise of China and the resurgence of the United States: China is now the world’s manufacturing behemoth, accounting for 28.8% of global manufacturing value added. In contrast, the share of the EU currently accounts for 16.9% and the USA for 15.4% (World Bank).

FIG 01

Manufacturing, value added (current US$)

Manufacturing, value added (current US$)

European industrial firms contend with Chinese rivals that often benefit from lower production costs, economies of scale and state support, while U.S. manufacturers are aided by cheaper energy and benefit from massive subsidies, such as the Inflation Reduction Act.

European industrial firms contend with Chinese rivals that often benefit from lower production costs, economies of scale and state support, while U.S. manufacturers are aided by cheaper energy and benefit from massive subsidies, such as the Inflation Reduction Act.

European industrial firms contend with Chinese rivals that often benefit from lower production costs, economies of scale and state support, while U.S. manufacturers are aided by cheaper energy and benefit from massive subsidies, such as the Inflation Reduction Act.

Note: Manufacturing refers to industries belonging to ISIC divisions 15-37. Value added is the net output of a sector after adding up all outputs and subtracting intermediate inputs.

The consequences of these macro headwinds and global competition are evident in key industrial health indexes, such as the PMI (Purchasing managers' index), the industrial producer prices index as well as the industrial production index:

The consequences of these macro headwinds and global competition are evident in key industrial health indexes, such as the PMI (Purchasing managers' index), the industrial producer prices index as well as the industrial production index:

The consequences of these macro headwinds and global competition are evident in key industrial health indexes, such as the PMI (Purchasing managers' index), the industrial producer prices index as well as the industrial production index:

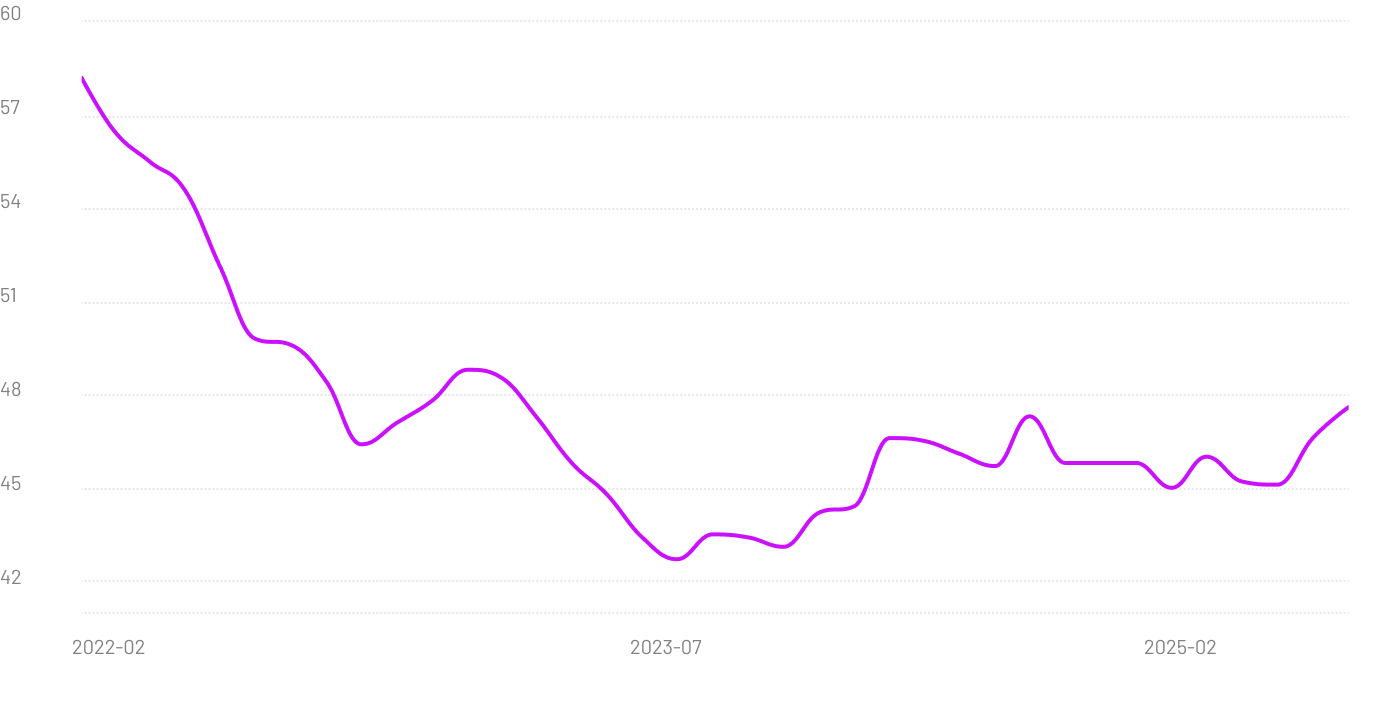

FIG 02

Manufacturing PMI

The manufacturing PMI is an economic indicator derived from monthly surveys of private sector companies, providing insight into the economic health of the manufacturing and service sectors. A PMI reading above 50 indicates expansion, below 50 signifies contraction. Throughout much of 2023, the index remains in the mid‐40s, signalling continued weakness in manufacturing activity (S&P Global).

The manufacturing PMI is an economic indicator derived from monthly surveys of private sector companies, providing insight into the economic health of the manufacturing and service sectors. A PMI reading above 50 indicates expansion, below 50 signifies contraction. Throughout much of 2023, the index remains in the mid‐40s, signalling continued weakness in manufacturing activity (S&P Global).

The manufacturing PMI is an economic indicator derived from monthly surveys of private sector companies, providing insight into the economic health of the manufacturing and service sectors. A PMI reading above 50 indicates expansion, below 50 signifies contraction. Throughout much of 2023, the index remains in the mid‐40s, signalling continued weakness in manufacturing activity (S&P Global).

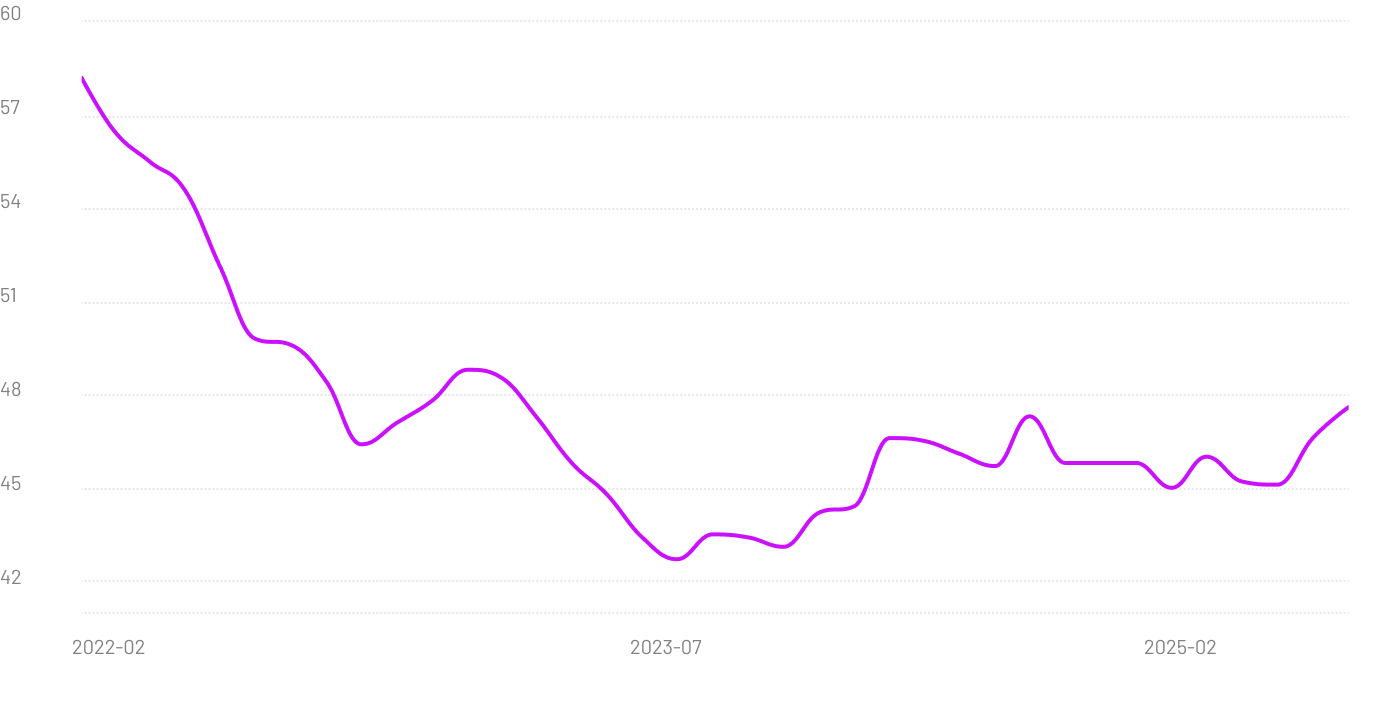

FIG 03

Industrial producer prices index

Industrial producer prices, a business-cycle indicator showing the development of transaction prices for the monthly industrial output of economic activities, began to climb in June 2020, with growth accelerating in late 2021 and early 2022, resulting in an almost two‐thirds increase by September 2022. Between September 2022 and July 2023, prices contracted nearly as rapidly as they had risen. Since then, they have stabilised, albeit at a historically high level.

Industrial producer prices, a business-cycle indicator showing the development of transaction prices for the monthly industrial output of economic activities, began to climb in June 2020, with growth accelerating in late 2021 and early 2022, resulting in an almost two‐thirds increase by September 2022. Between September 2022 and July 2023, prices contracted nearly as rapidly as they had risen. Since then, they have stabilised, albeit at a historically high level.

Industrial producer prices, a business-cycle indicator showing the development of transaction prices for the monthly industrial output of economic activities, began to climb in June 2020, with growth accelerating in late 2021 and early 2022, resulting in an almost two‐thirds increase by September 2022. Between September 2022 and July 2023, prices contracted nearly as rapidly as they had risen. Since then, they have stabilised, albeit at a historically high level.

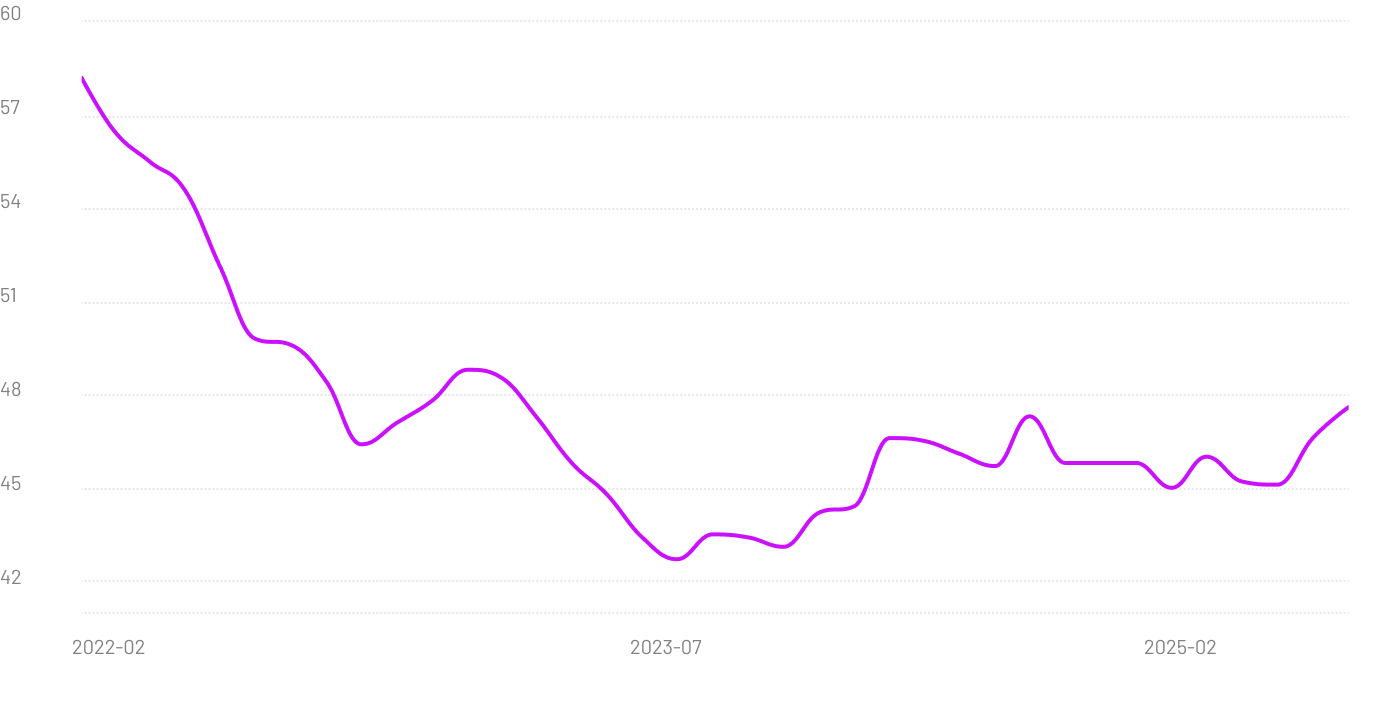

FIG 04

Industrial production index

The industrial production index measures changes in the volume of output at monthly intervals. It illustrates the volume trend in value added over a given reference period. The graph shows the onset of the COVID‐19 pandemic coincides with a steep plunge to the mid‐70s, after which output recovers swiftly. In the following months, production stagnates between the mid‐ and high‐90 mark, indicating that overall industrial output has rebounded yet remains slightly below its pre‐pandemic peak.

The industrial production index measures changes in the volume of output at monthly intervals. It illustrates the volume trend in value added over a given reference period. The graph shows the onset of the COVID‐19 pandemic coincides with a steep plunge to the mid‐70s, after which output recovers swiftly. In the following months, production stagnates between the mid‐ and high‐90 mark, indicating that overall industrial output has rebounded yet remains slightly below its pre‐pandemic peak.

The industrial production index measures changes in the volume of output at monthly intervals. It illustrates the volume trend in value added over a given reference period. The graph shows the onset of the COVID‐19 pandemic coincides with a steep plunge to the mid‐70s, after which output recovers swiftly. In the following months, production stagnates between the mid‐ and high‐90 mark, indicating that overall industrial output has rebounded yet remains slightly below its pre‐pandemic peak.

If you take a look at the data above and think that the current macro climate is extremely tough, you’re right. Europe’s industrial sector contends with high input costs, reconfigured supply chains, an energy transition and intense global competition. The net effect is that European industrial players must double down on innovation, increase operational efficiency and move up the value chain to stay competitive, especially as global trade dynamics become more complex (think techno-nationalism and increased export controls).

Yet, the EU's efforts in advanced technologies, such as AI and cloud computing, are still at a nascent stage - at present, the EU's public investment in artificial intelligence is merely 4% of that invested by the U.S and the EU’s global share of granted AI patents is only about 2.03% (European Commission).

It’s time to change that.

At Kausal Labs, we believe Europe now has a real shot at becoming the leading industrial AI player - that’s why we’ve made it our core mission to accelerate digital transformation and innovation of the industrial sector by bringing advanced AI tech into operation.

If you take a look at the data above and think that the current macro climate is extremely tough, you’re right. Europe’s industrial sector contends with high input costs, reconfigured supply chains, an energy transition and intense global competition. The net effect is that European industrial players must double down on innovation, increase operational efficiency and move up the value chain to stay competitive, especially as global trade dynamics become more complex (think techno-nationalism and increased export controls).

Yet, the EU's efforts in advanced technologies, such as AI and cloud computing, are still at a nascent stage - at present, the EU's public investment in artificial intelligence is merely 4% of that invested by the U.S and the EU’s global share of granted AI patents is only about 2.03% (European Commission).

It’s time to change that.

At Kausal Labs, we believe Europe now has a real shot at becoming the leading industrial AI player - that’s why we’ve made it our core mission to accelerate digital transformation and innovation of the industrial sector by bringing advanced AI tech into operation.

If you take a look at the data above and think that the current macro climate is extremely tough, you’re right. Europe’s industrial sector contends with high input costs, reconfigured supply chains, an energy transition and intense global competition. The net effect is that European industrial players must double down on innovation, increase operational efficiency and move up the value chain to stay competitive, especially as global trade dynamics become more complex (think techno-nationalism and increased export controls).

Yet, the EU's efforts in advanced technologies, such as AI and cloud computing, are still at a nascent stage - at present, the EU's public investment in artificial intelligence is merely 4% of that invested by the U.S and the EU’s global share of granted AI patents is only about 2.03% (European Commission).

It’s time to change that.

At Kausal Labs, we believe Europe now has a real shot at becoming the leading industrial AI player - that’s why we’ve made it our core mission to accelerate digital transformation and innovation of the industrial sector by bringing advanced AI tech into operation.

02 - AI/ACC

Accelerating industrial transformation with AI

Accelerating industrial transformation with AI

Accelerating industrial transformation with AI

When a former central banker talks about “integrating AI ‘vertically’ into European industry” as a critical factor in unlocking higher productivity and over $100 billion in potential gains per year (Draghi report), you know that the technology finally has its watershed moment. AI rapidly became the fastest growing technology of recent decades. Developments are occurring in weeks, not months or years. Just last year alone, there were over 20.000 ML papers published on arXiv, vs. 18.700 papers the year before.

When a former central banker talks about “integrating AI ‘vertically’ into European industry” as a critical factor in unlocking higher productivity and over $100 billion in potential gains per year (Draghi report), you know that the technology finally has its watershed moment. AI rapidly became the fastest growing technology of recent decades. Developments are occurring in weeks, not months or years. Just last year alone, there were over 20.000 ML papers published on arXiv, vs. 18.700 papers the year before.

When a former central banker talks about “integrating AI ‘vertically’ into European industry” as a critical factor in unlocking higher productivity and over $100 billion in potential gains per year (Draghi report), you know that the technology finally has its watershed moment. AI rapidly became the fastest growing technology of recent decades. Developments are occurring in weeks, not months or years. Just last year alone, there were over 20.000 ML papers published on arXiv, vs. 18.700 papers the year before.

FIG 05

AI/ML related arXiv submissions

ArXiv is an open-access repository for e-prints in physics, mathematics, computer science, and related fields. Established in 1991, it enables researchers to share findings before peer-reviewed publication. Specifically, in the field of AI and ML, the number of monthly papers grows exponentially with a doubling rate of roughly 23 months.

ArXiv is an open-access repository for e-prints in physics, mathematics, computer science, and related fields. Established in 1991, it enables researchers to share findings before peer-reviewed publication. Specifically, in the field of AI and ML, the number of monthly papers grows exponentially with a doubling rate of roughly 23 months.

ArXiv is an open-access repository for e-prints in physics, mathematics, computer science, and related fields. Established in 1991, it enables researchers to share findings before peer-reviewed publication. Specifically, in the field of AI and ML, the number of monthly papers grows exponentially with a doubling rate of roughly 23 months.

Due to increasing adoption of AI and automation software, cloud and edge technologies, industrials have access to more data and off-the-shelf AI/ML tooling than ever before. Yet, accelerated by the recent LLM hype, AI often either remains stuck in R&D experiments or is hastily implemented top-down ("AI for AI’s sake"), instead of becoming a scalable source of new value that positively impacts the bottom line. There are two main root causes for it: On the technical side, a lack of MLOps, data and model management practices makes it challenging to scale models from one-time insights into an embedded, iterative element of operations. On the strategic side, succeeding in making AI operational requires strong collaboration between technical and operational teams in order to successfully translate business outcomes into code. If you’ve ever witnessed a business stakeholder discuss a new project with a machine learning engineer, you know this translation challenge. Consequently, we've covered these two challenges in our service offering (Kausal Labs Homepage) by properly embedding AI models into the enterprise software stack and by heavily utilising frameworks that have proven to foster cross-function collaboration, such as Design Sprints.

Another layer that drastically impacts the operationalisation of AI is the rapid advancement and widespread enterprise adoption of large-language models (LLMs). It is already industry consensus that the fierce global competition between private and open-source LLM foundation model developers will lead to a rapid commoditization of LLM models. Consequently, LLM developers will shift their focus to building off-the-shelf LLM-based services and AI agents, such as the recently launched APIs and tools by Open AI (Open AI Platform). Many use cases that previously were custom-built are today well covered by off-the-shelf LLM-powered AI agents, which maintain control over their processes and tool usage, dynamically adapting to the demands of a task. This is especially significant for the automation of organisational support processes, as LLM-powered AI agents thrive in dynamic workflows, such as customer support, internal knowledge management or procure-to-pay/order-to-cash processes. Supporting capabilities like optical character recognition (OCR) are a standard component of LLM-based agents, for instance the just released Mistral OCR model that outperforms previously leading models and turns any PDF document into an AI-ready markdown file. New standards like the Model Context Protocol (MCP) by Anthropic provide frameworks for connecting AI agents to the systems where data lives, such as content repositories, business tools and development environments. Consequently, the rapidly advancing capabilities of LLM-powered agents will massively boost operational efficiency through process automations.

As with any advanced technology, early adopters will reap the initial rewards, but we predict that off-the-shelf LLM-powered agentic workflow automations will ultimately become a universally adopted technology. Put bluntly: Using AI to automate internal processes becomes a basic requirement for survival.

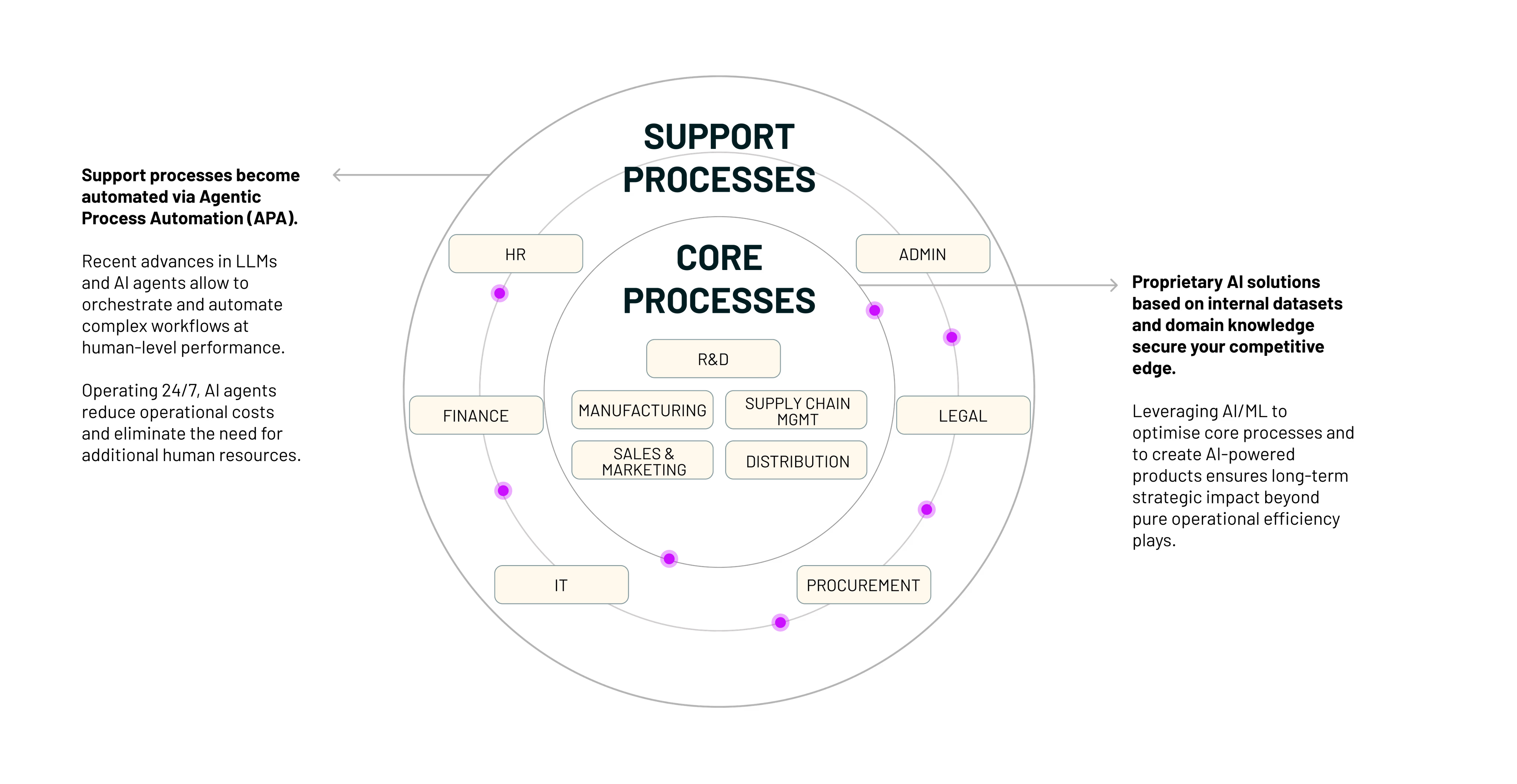

As a logical consequence, the only AI moat left lies in combining proprietary datasets, domain expertise and state-of-the-art algorithms that deliver defendable differentiation in organisational core processes and products. This is particularly relevant for core processes (R&D, product development, supply chain optimisation) where AI insights can lead to innovative offerings, superior performance, or other strategic advantages.

Due to increasing adoption of AI and automation software, cloud and edge technologies, industrials have access to more data and off-the-shelf AI/ML tooling than ever before. Yet, accelerated by the recent LLM hype, AI often either remains stuck in R&D experiments or is hastily implemented top-down ("AI for AI’s sake"), instead of becoming a scalable source of new value that positively impacts the bottom line. There are two main root causes for it: On the technical side, a lack of MLOps, data and model management practices makes it challenging to scale models from one-time insights into an embedded, iterative element of operations. On the strategic side, succeeding in making AI operational requires strong collaboration between technical and operational teams in order to successfully translate business outcomes into code. If you’ve ever witnessed a business stakeholder discuss a new project with a machine learning engineer, you know this translation challenge. Consequently, we've covered these two challenges in our service offering (Kausal Labs Homepage) by properly embedding AI models into the enterprise software stack and by heavily utilising frameworks that have proven to foster cross-function collaboration, such as Design Sprints.

Another layer that drastically impacts the operationalisation of AI is the rapid advancement and widespread enterprise adoption of large-language models (LLMs). It is already industry consensus that the fierce global competition between private and open-source LLM foundation model developers will lead to a rapid commoditization of LLM models. Consequently, LLM developers will shift their focus to building off-the-shelf LLM-based services and AI agents, such as the recently launched APIs and tools by Open AI (Open AI Platform). Many use cases that previously were custom-built are today well covered by off-the-shelf LLM-powered AI agents, which maintain control over their processes and tool usage, dynamically adapting to the demands of a task. This is especially significant for the automation of organisational support processes, as LLM-powered AI agents thrive in dynamic workflows, such as customer support, internal knowledge management or procure-to-pay/order-to-cash processes. Supporting capabilities like optical character recognition (OCR) are a standard component of LLM-based agents, for instance the just released Mistral OCR model that outperforms previously leading models and turns any PDF document into an AI-ready markdown file. New standards like the Model Context Protocol (MCP) by Anthropic provide frameworks for connecting AI agents to the systems where data lives, such as content repositories, business tools and development environments. Consequently, the rapidly advancing capabilities of LLM-powered agents will massively boost operational efficiency through process automations.

As with any advanced technology, early adopters will reap the initial rewards, but we predict that off-the-shelf LLM-powered agentic workflow automations will ultimately become a universally adopted technology. Put bluntly: Using AI to automate internal processes becomes a basic requirement for survival.

As a logical consequence, the only AI moat left lies in combining proprietary datasets, domain expertise and state-of-the-art algorithms that deliver defendable differentiation in organisational core processes and products. This is particularly relevant for core processes (R&D, product development, supply chain optimisation) where AI insights can lead to innovative offerings, superior performance, or other strategic advantages.

Due to increasing adoption of AI and automation software, cloud and edge technologies, industrials have access to more data and off-the-shelf AI/ML tooling than ever before. Yet, accelerated by the recent LLM hype, AI often either remains stuck in R&D experiments or is hastily implemented top-down ("AI for AI’s sake"), instead of becoming a scalable source of new value that positively impacts the bottom line. There are two main root causes for it: On the technical side, a lack of MLOps, data and model management practices makes it challenging to scale models from one-time insights into an embedded, iterative element of operations. On the strategic side, succeeding in making AI operational requires strong collaboration between technical and operational teams in order to successfully translate business outcomes into code. If you’ve ever witnessed a business stakeholder discuss a new project with a machine learning engineer, you know this translation challenge. Consequently, we've covered these two challenges in our service offering (Kausal Labs Homepage) by properly embedding AI models into the enterprise software stack and by heavily utilising frameworks that have proven to foster cross-function collaboration, such as Design Sprints.

Another layer that drastically impacts the operationalisation of AI is the rapid advancement and widespread enterprise adoption of large-language models (LLMs). It is already industry consensus that the fierce global competition between private and open-source LLM foundation model developers will lead to a rapid commoditization of LLM models. Consequently, LLM developers will shift their focus to building off-the-shelf LLM-based services and AI agents, such as the recently launched APIs and tools by Open AI (Open AI Platform). Many use cases that previously were custom-built are today well covered by off-the-shelf LLM-powered AI agents, which maintain control over their processes and tool usage, dynamically adapting to the demands of a task. This is especially significant for the automation of organisational support processes, as LLM-powered AI agents thrive in dynamic workflows, such as customer support, internal knowledge management or procure-to-pay/order-to-cash processes. Supporting capabilities like optical character recognition (OCR) are a standard component of LLM-based agents, for instance the just released Mistral OCR model that outperforms previously leading models and turns any PDF document into an AI-ready markdown file. New standards like the Model Context Protocol (MCP) by Anthropic provide frameworks for connecting AI agents to the systems where data lives, such as content repositories, business tools and development environments. Consequently, the rapidly advancing capabilities of LLM-powered agents will massively boost operational efficiency through process automations.

As with any advanced technology, early adopters will reap the initial rewards, but we predict that off-the-shelf LLM-powered agentic workflow automations will ultimately become a universally adopted technology. Put bluntly: Using AI to automate internal processes becomes a basic requirement for survival.

As a logical consequence, the only AI moat left lies in combining proprietary datasets, domain expertise and state-of-the-art algorithms that deliver defendable differentiation in organisational core processes and products. This is particularly relevant for core processes (R&D, product development, supply chain optimisation) where AI insights can lead to innovative offerings, superior performance, or other strategic advantages.

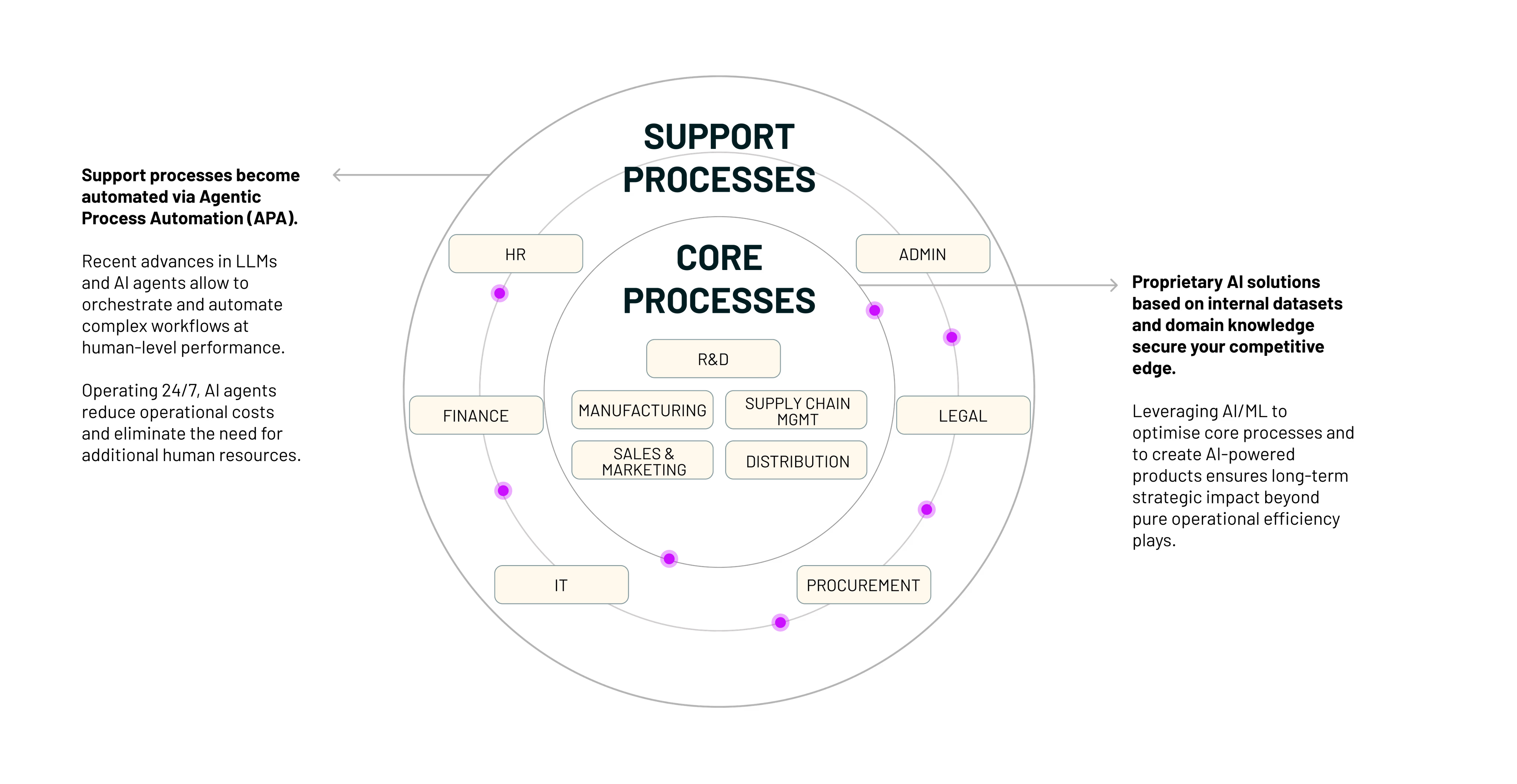

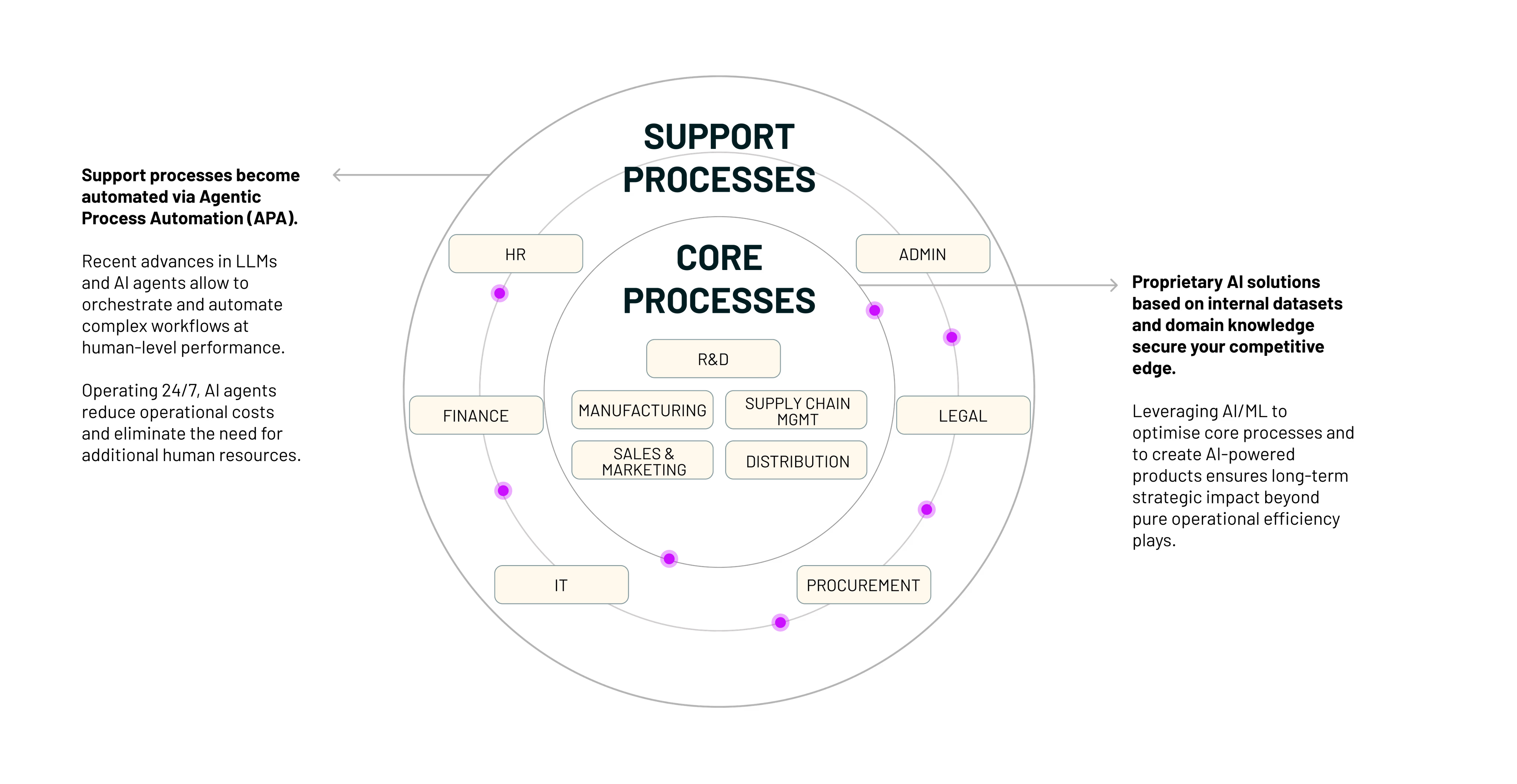

FIG 06

Kausal Labs AI adoption framework

Kausal Labs AI adoption framework

Our hybrid AI framework weaves together AI agents for cost-effective automation and proprietary AI solutions for unique differentiation in core processes and products. By fusing the efficiency gains of standardised solutions with the distinctive capabilities of proprietary AI development, companies can continuously adapt to a dynamic marketplace.

Our hybrid AI framework weaves together AI agents for cost-effective automation and proprietary AI solutions for unique differentiation in core processes and products. By fusing the efficiency gains of standardised solutions with the distinctive capabilities of proprietary AI development, companies can continuously adapt to a dynamic marketplace.

Our hybrid AI framework weaves together AI agents for cost-effective automation and proprietary AI solutions for unique differentiation in core processes and products. By fusing the efficiency gains of standardised solutions with the distinctive capabilities of proprietary AI development, companies can continuously adapt to a dynamic marketplace.

Industrial firms that combat current challenges by smartly using AI will reach new levels of operational efficiency that tech laggards can simply not match, risking sleepwalking into a structural cost disadvantage:

Industrial firms that combat current challenges by smartly using AI will reach new levels of operational efficiency that tech laggards can simply not match, risking sleepwalking into a structural cost disadvantage:

Industrial firms that combat current challenges by smartly using AI will reach new levels of operational efficiency that tech laggards can simply not match, risking sleepwalking into a structural cost disadvantage:

Reduce machine downtime and extend asset lifespans.

Reduce machine downtime and extend asset lifespans.

Reduce machine downtime and extend asset lifespans.

Operational efficiency

By deploying AI algorithms on data from sensors (vibration, temperature, etc.), companies can reduce machine downtime by 35–50% and extend asset lifespans by 20–40% (IBM, 2023).

By deploying AI algorithms on data from sensors (vibration, temperature, etc.), companies can reduce machine downtime by 35–50% and extend asset lifespans by 20–40% (IBM, 2023).

By deploying AI algorithms on data from sensors (vibration, temperature, etc.), companies can reduce machine downtime by 35–50% and extend asset lifespans by 20–40% (IBM, 2023).

Build resilient and smart supply networks.

Build resilient and smart supply networks.

Build resilient and smart supply networks.

Supply chain resilience

AI makes supply and logistics networks smarter and more robust. AI-powered demand forecasting systems have shown to reduce forecast errors by up to 30%, ensuring better alignment between inventory and demand patterns (Goswami et al., 2022).

AI makes supply and logistics networks smarter and more robust. AI-powered demand forecasting systems have shown to reduce forecast errors by up to 30%, ensuring better alignment between inventory and demand patterns (Goswami et al., 2022).

AI makes supply and logistics networks smarter and more robust. AI-powered demand forecasting systems have shown to reduce forecast errors by up to 30%, ensuring better alignment between inventory and demand patterns (Goswami et al., 2022).

Boost production, throughput and safety.

Boost production, throughput and safety.

Boost production, throughput and safety.

Worker augmentation

Increasingly, industrial firms are using AI to augment their workforce – enhancing productivity and partially mitigating labour shortages. One prominent example is the rise of AI-driven robotics, especially collaborative robots (cobots) that work alongside humans on the factory floor. One case showed cobot integration boosting welding production by 200% for a manufacturer (IFR).

Increasingly, industrial firms are using AI to augment their workforce – enhancing productivity and partially mitigating labour shortages. One prominent example is the rise of AI-driven robotics, especially collaborative robots (cobots) that work alongside humans on the factory floor. One case showed cobot integration boosting welding production by 200% for a manufacturer (IFR).

Increasingly, industrial firms are using AI to augment their workforce – enhancing productivity and partially mitigating labour shortages. One prominent example is the rise of AI-driven robotics, especially collaborative robots (cobots) that work alongside humans on the factory floor. One case showed cobot integration boosting welding production by 200% for a manufacturer (IFR).

Cut energy consumption and reduce maintenance costs.

Cut energy consumption and reduce maintenance costs.

Cut energy consumption and reduce maintenance costs.

Sustainability & energy management

AI systems monitor energy consumption in real time and automatically adjust equipment settings to eliminate waste. For example, AI learns to stagger the start of large motors or compressors in a plant to avoid peak load spikes.

AI systems monitor energy consumption in real time and automatically adjust equipment settings to eliminate waste. For example, AI learns to stagger the start of large motors or compressors in a plant to avoid peak load spikes.

AI systems monitor energy consumption in real time and automatically adjust equipment settings to eliminate waste. For example, AI learns to stagger the start of large motors or compressors in a plant to avoid peak load spikes.

At the same time, utilising AI for operational efficiency plays alone would hugely downplay its potential. Instead of being treated as a purely technical topic, AI should be viewed through a business model point of view, i.e. providing opportunities to enhance existing products and operations with AI and/or to create entirely new process innovations, revenue streams and business models.

At the same time, utilising AI for operational efficiency plays alone would hugely downplay its potential. Instead of being treated as a purely technical topic, AI should be viewed through a business model point of view, i.e. providing opportunities to enhance existing products and operations with AI and/or to create entirely new process innovations, revenue streams and business models.

At the same time, utilising AI for operational efficiency plays alone would hugely downplay its potential. Instead of being treated as a purely technical topic, AI should be viewed through a business model point of view, i.e. providing opportunities to enhance existing products and operations with AI and/or to create entirely new process innovations, revenue streams and business models.

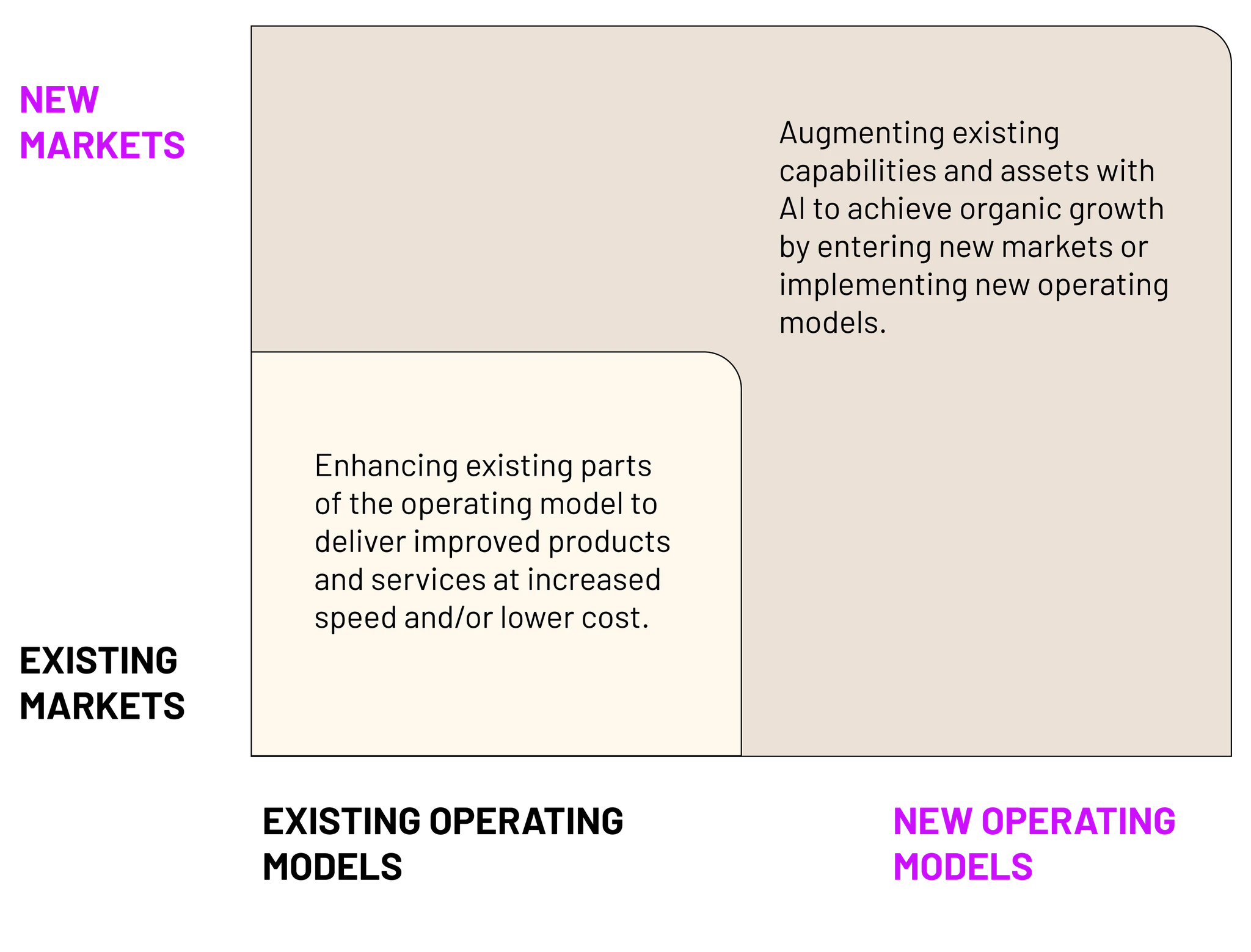

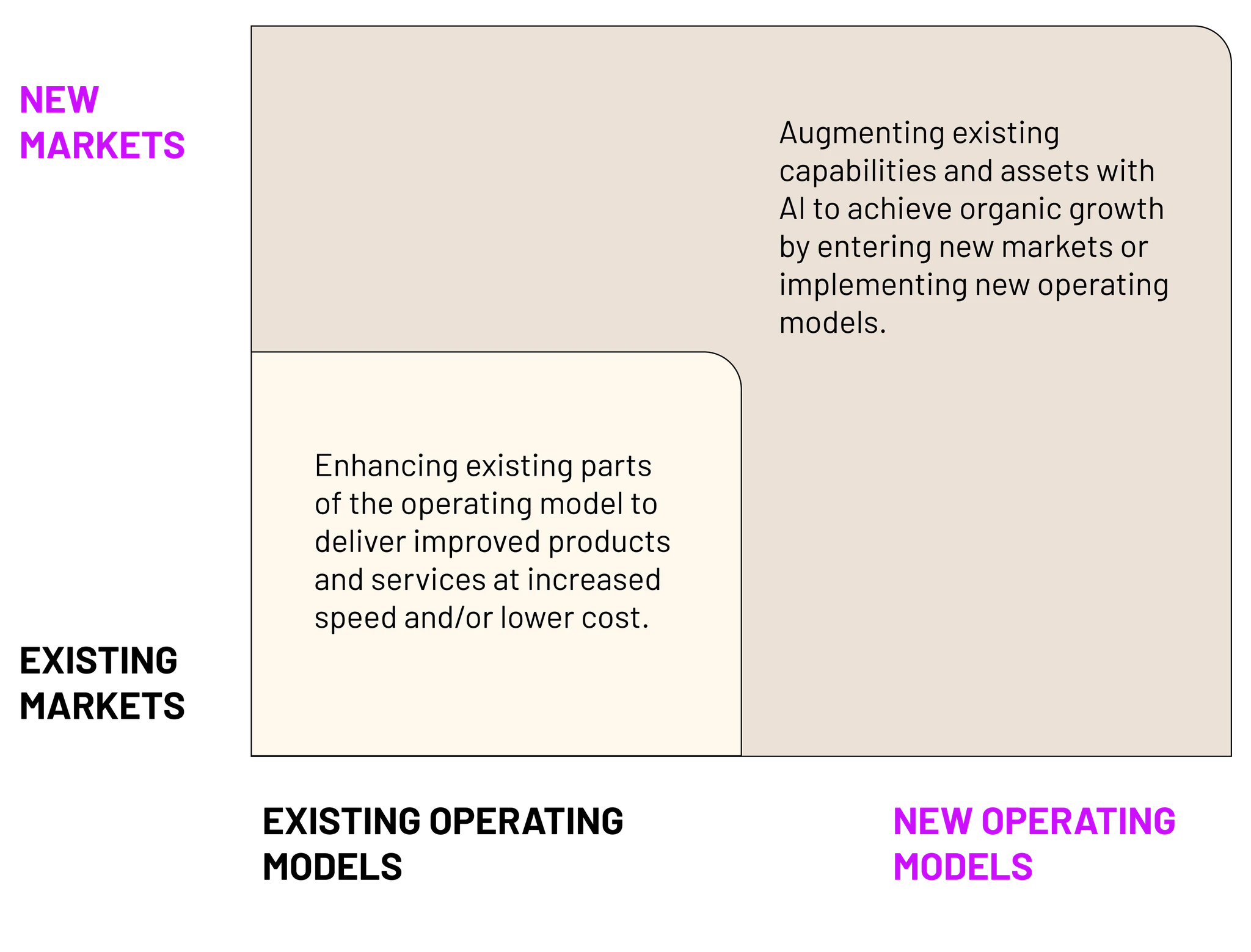

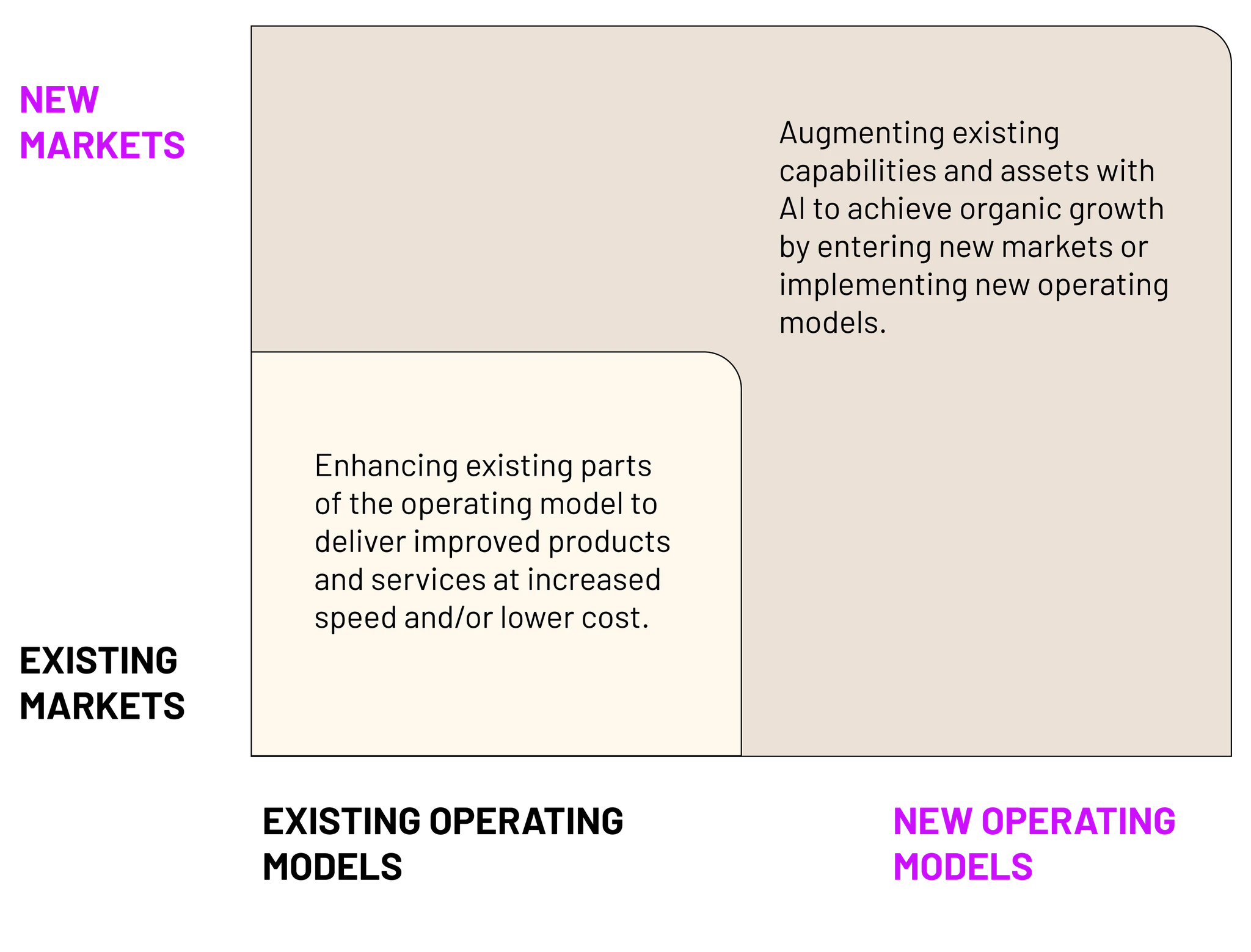

FIG 07

Boosting organic growth with AI

Beyond optimising the existing business, AI leaders focus on near-term organic growth and margin expansion. A key success factor for organic growth is to radically focus on leveraging existing capabilities and assets, such as products, channels, supply chains or proprietary datasets, in new ways. This allows to supercharge growth in healthy, but slower-growing businesses, build market share in existing areas through better products or expand into new market segments. Margin expansion is often a by-product, as fully AI-enabled operating and business models build on lean and automated processes.

Beyond optimising the existing business, AI leaders focus on near-term organic growth and margin expansion. A key success factor for organic growth is to radically focus on leveraging existing capabilities and assets, such as products, channels, supply chains or proprietary datasets, in new ways. This allows to supercharge growth in healthy, but slower-growing businesses, build market share in existing areas through better products or expand into new market segments. Margin expansion is often a by-product, as fully AI-enabled operating and business models build on lean and automated processes.

Beyond optimising the existing business, AI leaders focus on near-term organic growth and margin expansion. A key success factor for organic growth is to radically focus on leveraging existing capabilities and assets, such as products, channels, supply chains or proprietary datasets, in new ways. This allows to supercharge growth in healthy, but slower-growing businesses, build market share in existing areas through better products or expand into new market segments. Margin expansion is often a by-product, as fully AI-enabled operating and business models build on lean and automated processes.

A typical example for enhancing existing operating models would be an automotive manufacturer that implements AI-driven predictive maintenance in its existing production lines. Sensors on assembly machinery continuously feed operational data into a machine learning model, which predicts machine failures and necessary maintenance tasks ahead of time. This allows the company to reduce downtime, lower operational costs, and deliver higher-quality vehicles more quickly to its established markets.

In contrast, an example for entering new markets under new operating models would be AI-powered smart grid services by energy companies. An established energy provider leverages AI to manage distributed energy resources (DERs), such as solar installations, battery storage systems, and smart EV chargers, creating a flexible energy-sharing marketplace. This approach enables consumers to trade electricity directly with one another, establishing a new digitally-driven operating model. Real-life examples include UK’s Fuse, which is developing a peer-to-peer energy marketplace using AI to optimise DERs, and Germany’s 1Komma5°, utilising its Heartbeat AI platform to manage distributed energy assets and provide grid-balancing services.

Beyond tech startups, one of our flagship project case studies shows that also established firms can boost organic growth through AI innovation: Together with a leading bank, we developed a novel AI-based underwriting model that allowed to quickly assess creditworthiness of a new business customer segment. In order to develop the new models, we initially searched for public datasets and talked to specialised data providers, which either didn't have the data or charged six figures for datasets that were only partially meeting our requirements. Utilising synthetic data for developing credit decisioning models was also ruled out by the client. We ultimately successfully leveraged in-house proprietary data to develop and validate the models, which proves the often-cited thesis that many incumbents sit on extremely valuable, unique data that competitors cannot easily replicate to build AI-driven products.

In this case, the AI models enabled an instant, fully API-driven and automated risk assessment of new loan applications. Compared to the previously semi-manual credit checks, the new digital product already proved to cut decisioning from weeks to seconds. Beyond that, it allowed to launch an entirely new digital business model for the bank by placing loan offers on third-party digital platforms, which allowed to cut customer acquisition costs.

A typical example for enhancing existing operating models would be an automotive manufacturer that implements AI-driven predictive maintenance in its existing production lines. Sensors on assembly machinery continuously feed operational data into a machine learning model, which predicts machine failures and necessary maintenance tasks ahead of time. This allows the company to reduce downtime, lower operational costs, and deliver higher-quality vehicles more quickly to its established markets.

In contrast, an example for entering new markets under new operating models would be AI-powered smart grid services by energy companies. An established energy provider leverages AI to manage distributed energy resources (DERs), such as solar installations, battery storage systems, and smart EV chargers, creating a flexible energy-sharing marketplace. This approach enables consumers to trade electricity directly with one another, establishing a new digitally-driven operating model. Real-life examples include UK’s Fuse, which is developing a peer-to-peer energy marketplace using AI to optimise DERs, and Germany’s 1Komma5°, utilising its Heartbeat AI platform to manage distributed energy assets and provide grid-balancing services.

Beyond tech startups, one of our flagship project case studies shows that also established firms can boost organic growth through AI innovation: Together with a leading bank, we developed a novel AI-based underwriting model that allowed to quickly assess creditworthiness of a new business customer segment. In order to develop the new models, we initially searched for public datasets and talked to specialised data providers, which either didn't have the data or charged six figures for datasets that were only partially meeting our requirements. Utilising synthetic data for developing credit decisioning models was also ruled out by the client. We ultimately successfully leveraged in-house proprietary data to develop and validate the models, which proves the often-cited thesis that many incumbents sit on extremely valuable, unique data that competitors cannot easily replicate to build AI-driven products.

In this case, the AI models enabled an instant, fully API-driven and automated risk assessment of new loan applications. Compared to the previously semi-manual credit checks, the new digital product already proved to cut decisioning from weeks to seconds. Beyond that, it allowed to launch an entirely new digital business model for the bank by placing loan offers on third-party digital platforms, which allowed to cut customer acquisition costs.

FINANCIAL SERVICES

Unlocking a €50M income stream from data-driven underwriting

Unlocking a €50M income stream from data-driven underwriting

CHALLENGE

Quickly ramping up a loan portfolio of an entirely new client segment.

SOLUTION

We developed a digital lending platform and innovative AI-based risk model from scratch, which enabled instant loan decisioning and dynamic pricing with an innovative new lending product.

OUTCOME

Unlocking a new €50 million income stream from fully automated lending, enabling a time-to-yes from weeks to seconds.

03 - BUILD WITH US

Your entrepreneurial execution partner

Your entrepreneurial execution partner

Your entrepreneurial execution partner

The world doesn't need another academic AI consultancy or technical data science agency. It needs hands-on teams that are focused on deploying operational, AI-enabled solutions that impact your bottom line.

As ex-operators, founders and advisors of leading AI and tech companies, we combine deep technical expertise with bottom-line focused digital business transformation experience. We offer a full-stack, multidisciplinary team of ML/AI experts, designers, developers and consultants. Above all, we’re built on Nordic integrity, so we say what we do and do what we say: everyone performs.

Based in Amsterdam and Helsinki, found wherever our clients are.

The world doesn't need another academic AI consultancy or technical data science agency. It needs hands-on teams that are focused on deploying operational, AI-enabled solutions that impact your bottom line.

As ex-operators, founders and advisors of leading AI and tech companies, we combine deep technical expertise with bottom-line focused digital business transformation experience. We offer a full-stack, multidisciplinary team of ML/AI experts, designers, developers and consultants. Above all, we’re built on Nordic integrity, so we say what we do and do what we say: everyone performs.

Based in Amsterdam and Helsinki, found wherever our clients are.

The world doesn't need another academic AI consultancy or technical data science agency. It needs hands-on teams that are focused on deploying operational, AI-enabled solutions that impact your bottom line.

As ex-operators, founders and advisors of leading AI and tech companies, we combine deep technical expertise with bottom-line focused digital business transformation experience. We offer a full-stack, multidisciplinary team of ML/AI experts, designers, developers and consultants. Above all, we’re built on Nordic integrity, so we say what we do and do what we say: everyone performs.

Based in Amsterdam and Helsinki, found wherever our clients are.

Adrian Klee

Founder & MD